The RBI has given a boost to the economy in these testing times. But India Inc. argues that this won't be of help in the absence of demand. This is flawed thinking

On March 27, in a bid to resuscitate the economy devastated by the Coronavirus, the Reserve Bank of India (RBI) Governor, Shaktikanta Das, announced a host of measures to inject liquidity into the country’s financial system; reduce the cost of capital and ease the stress of loan repayments. These included reduction in policy rate by 75 basis points to 4.4 per cent; a three-month moratorium on payment of installments in respect of all term loans outstanding on March 31; relaxation in the norms for cash credit and working capital limits; reduction in cash reserve ratio (CRR) by 100 basis points to three per cent; auction of targetted long-term repo operations (TLTRO) of three-year tenor for Rs 1,00,000 crore at floating rate; accommodation under Marginal Standing Facility (MSF) to be increased from two per cent of the statutory liquidity ratio (SLR) to three per cent, with immediate effect till June 30.

On April 17, Das announced more measures. These included reduction in reverse repo rate (interest rate at which banks lend money to the RBI) by 25 basis points from the existing four per cent to 3.75 per cent and availability of Rs 50,000 crore directly under the TLTRO 2.0 window. Under it, banks can access three-year funding from the RBI to invest in investment grade papers of Non-Banking Financial Companies (NBFCs), with at least 50 per cent invested in small and mid-sized NBFCs and micro-finance institutions (MFIs). Banks have a month to invest this amount and more is promised, depending on the requirement. The RBI also gave a Rs 50,000 crore special refinance facility for financial institutions (FIs). Of the Rs 50,000 crore, Rs 25,000 crore will go to the National Bank for Agriculture and Rural Development for refinancing regional rural banks, cooperative banks and MFIs; Rs 15,000 crore to the Small Industries Development Bank of India for on-lending or refinancing and Rs 10,000 crore to the National Housing Bank for supporting mortgage lenders.

The RBI has also eased asset classification norms for all accounts where moratorium or deferment has been applied. This means that all accounts covered under the moratorium from March 1 to May 31 will be treated as Non-Performing Assets (NPAs) from 180 days overdue instead of 90 days overdue as per extant rule. The banks will have to maintain additional 10 per cent provisioning on these standstill accounts over the two quarters ending March and June.

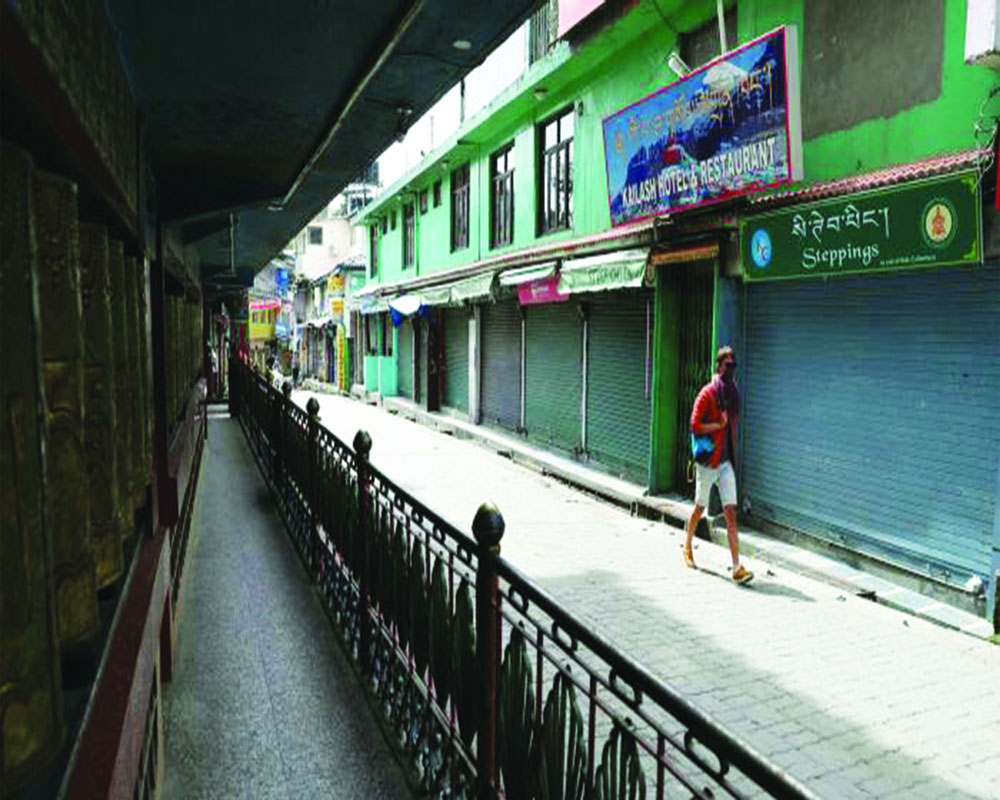

Furthermore, the banking regulator has extended the 210-day resolution period for all large stressed accounts identified under its June 7, 2019 circular (on its expiration, if banks are not ready with a resolution plan, insolvency proceedings are initiated under the Insolvency and Bankruptcy Code) by a further 90 days. How do these measures help? To comprehend this, we need to look at the dynamics of how Corona is impacting businesses. In a bid to stop the spread of the virus, the Government has imposed a nationwide lockdown that ends on May 3. As a result all economic activities, except for essentials, have come to a grinding halt. When businesses don’t run, they don’t generate revenue, hampering their ability to pay wages, make payments to vendors/suppliers and so on. This leads to a spiralling “disruptive” effect on the entire demand-supply chain. Tens of millions of workers not getting wages and salaries causes widespread destruction of demand; millions of vendors not getting payments means they are unable to honour their liabilities including payment of salaries to their own workers.

With cash flows of various entities viz. corporates, suppliers/vendors, workers/employees under stress, servicing of loans taken from banks and other FIs viz. NBFCs, MFIs suffers. This affects the ability of the latter to lend, creating a fresh wave of compression in demand.

The RBI’s package seeks to help businesses in two ways. First, by granting a moratorium, it exempts them from having to service their loans during March 1 to May 31 (though the lockdown period is 40 days, the balance 50 days — in the build-up to its commencement and the period after it ends — have been rightly included) besides ignoring these three months for determining if the loan has gone bad. In other words, it completely immunises the firm from the impact of the lockdown on its ability to service the loan.

Second, firms can get more money from banks at lower interest rate (courtesy, relaxed norms for cash credit and working capital) which they can use to pay to vendors/suppliers and workers/employees (including for the period they don’t work, as wished by Modi) as also to fund new projects or expansion as and when there is exit from the lockdown and conditions are apt for resumption of economic activities. The measures announced by RBI on March 27 and April 17 have made available plenty of liquidity close to Rs 5,00,000 crore which can be utilised for financing business needs.

This comes along with a cut in repo rate by 0.75 per cent (this is on top of the cumulative reduction of 1.35 per cent during 2019) which will ensure that additional funds are available at lower costs. Further, by reducing the reverse repo rate from the existing four per cent to 3.75 per cent, the RBI has goaded banks to lend to businesses or buy Government securities instead of parking excess funds with itself (as on April 13, this amount was a gargantuan Rs 6,90,000 crore which the Governor wants to be released for spurring economic activity). The RBI has done all that was needed to give a boost to the economy in these testing times. But the industries and businesses argue that this won’t be of much help in the absence of demand. They argue what will they do with higher production when there are no buyers. They want the Government to come up with a “fiscal stimulus” package to put cash in the hands of the people. The demand ranges from two per cent of the Gross Domestic Product (GDP) to as high as 10 per cent or Rs 4,00,000 crore to Rs 20,00,000 crore. This is flawed thinking.

Undoubtedly, lack of demand is a problem; it existed even before the pandemic. Now it has got aggravated. But why should businesses depend entirely on the Government for boosting demand? Why can’t there be sharing of the responsibility? While, the latter can take care of the most vulnerable, particularly those in the informal sector such as daily wage earners, vendors, migrant labour and so on (already, it is doing this under the PM Garib Kalyan Yojna and more assistance can be given by extending the coverage), the former should provide continued support to all of their workers for the whole of three months. From where will the funds come? While companies, who have built enough cash reserves from their operations in the past, can use a portion of that to support their staff in this crisis situation, others not so blessed can take loans from banks and other FIs who have plenty of liquidity, courtesy massive injection by the apex bank. This should be taken as investment in the future.

As and when there is exit from the lockdown and economic activity resumes, the revenue stream from operations can help in servicing the loans. The banks need to ensure that money gets distributed in a “fair” and “equitable” manner. Under TLTRO 1.0, almost all of the funds released by the RBI or Rs 75,000 crore were given to big corporates. This should be avoided even as a major portion of the package is given to small businesses. The apex bank has tried to rectify this anomaly under the TLTRO 2.0 by reserving 50 per cent of liquidity injection for small and mid-sized NBFCs and MFIs. However, greater care is needed at the implementation level.

The above approach, even while providing the much-needed fillip to the economy, will also have the added advantage of avoiding big slippage in fiscal deficit (inevitable if the Government is made to bear the entire burden of propping up demand) and disastrous implications in terms of spurring inflation, high interest rate, unsustainable debt and so on.

Meanwhile, all-out efforts should be made to defeat the pandemic expeditiously as that will help early resumption of economic activity and reduce the cost of revival.

(The writer is a New Delhi-based policy analyst)