Union Minister Arjun Ram Meghwal while addressing the FICCI-CASCADE’s ‘MASCRADE 2025’ on Thursday emphasized that GST 2.0 is not just about taxation — it is about making life easier for households and businesses.

“From filing 37 GST returns in a year in 2017 to only 3 today, this reform shows how governance can truly respond to industry’s voice. At the same time, we must clearly define illicit trade and work collectively to eliminate it. I assure you that the recommendations emerging from MASCRADE 2025 will be taken to the Government and acted upon,” Meghwal, the Minister of State (Independent Charge), Ministry of Law and Justice, Government of India, said.

On the occasion, Anil Rajput, Chairman, FICCI CASCADE congratulated our Prime Minister Narendra Modi for announcing the historic and bold GST 2.0 reforms, which is another step toward Viksit Bharat. “GST 2017 transformed our taxation landscape, and now GST 2.0 builds on that foundation with simplified rate structures and greater efficiency. GST 2.0 truly embodies the vision of ‘One Nation, One Tax.’ At FICCI CASCADE, we have long advocated for rational tax structures to reduce illicit trade. High tax rates create price gaps that fuel smuggling and counterfeiting. GST 2.0 addresses these concerns, and I urge policymakers to continue keeping the structure balanced to discourage illicit markets,” said Rajput.

Building on the spirit and success of Operation Sindoor, which demonstrated how clarity of purpose, precision, and coordination can dismantle entrenched threats, Rajput unveiled a new framework for our collective action against illicit trade. ‘SHIELD’ offers a structured and strategic approach to combating illicit trade in India. S is for strategic monitoring through tech-enabled surveillance across supply chains. H stands for Harnessing Technology like AI, blockchain, and analytics to detect anomalies. I is for Industry Collaboration, urging businesses to share intelligence and support enforcement. Edenotes Enforcement, calling for swift action and deterrence. L is for legal reforms, advocating stronger laws and faster trials. Lastly, D means Demand Reduction, stressing public awareness to curb consumption of smuggled and counterfeit goods and disrupt illicit markets at the root, he added.

In her video address, Gael Grooby, Director, Policy and Standards, World Customs Organisation, congratulated FICCI for its leadership in tackling illicit trade through this important platform. “Since our founding in 1952, the WCO has worked to support legitimate trade while countering illicit flows. This year’s WCO theme is ‘Customs Delivering on Efficiency, Security, and Prosperity’. Through initiatives like Operation STOP, we’ve disrupted counterfeit medical supply chains and protected consumers and economies alike. However, today’s landscape is changing. E-commerce has revolutionized trade, and while it creates opportunities, it also enables the rapid spread of counterfeits. To address this, we are investing in AI, real-time data sharing, and detection technologies to help customs better manage the rising volume of small packages. With India’s support, our Customs Enforcement Network (CEN) now offers enhanced data visualisation tools,” she said.

PK Malhotra, Former Secretary, Ministry of Law & Justice, Govt. of India, and Think Tank Member, FICCI CASCADE, said, “There are serious economic and social costs of illicit trade. While globalization has brought immense opportunities, it has also enabled a parallel economy — smuggling, counterfeiting, tax evasion, and trafficking that undermines our progress toward the UN Sustainable Development Goals. In India, the challenge is urgent. As we aim to become a $30 trillion economy by 2047, we must tackle this issue with sustained, coordinated action, backed by robust enforcement and clear, enforceable laws. Today’s discussions made it evident — illicit trade is no longer a fringe problem. It operates like a global, organized network, exploiting legal ambiguities and enforcement gaps. This fight cannot be won by governments alone. Industry must invest in authenticity and consumer protection. Citizens must be aware and vigilant. And we need deeper international collaboration to enable joint investigations, intelligence sharing, and harmonized standards.”

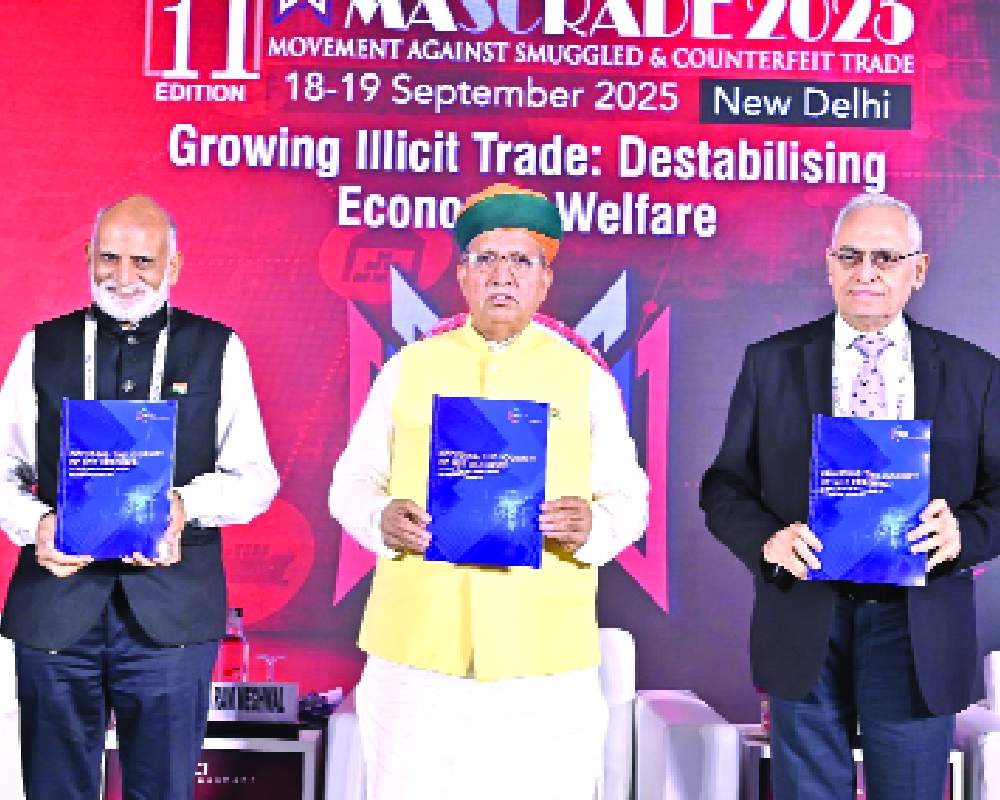

During the event, FICCI CASCADE, jointly with the Thought Arbitrage Research Institute (TARI), released its report - “Decoding the Journey of GST Reforms: GST and Its Effect on Economy, Business and Household Consumption”. The report affirms that GST 2.0 marks a landmark reform, reshaping India’s indirect tax system to directly improve ease of living for households and ease of doing business for enterprises. During its valedictory session, Enforcement officers, school children, and journalists were felicitated at the anti-counterfeiting and anti-smuggling awards ceremony held during MASCRADE 2025.

K Malhotra, Former Secretary, Ministry of Law & Justice, Govt. of India, and Think Tank Member, FICCI CASCADE, said, “There are serious economic and social costs of illicit trade. While globalisation has brought immense opportunities, it has also enabled a parallel economy — smuggling, counterfeiting, tax evasion, and trafficking that undermines our progress toward the UN Sustainable Development Goals. In India, the challenge is urgent. As we aim to become a $30 trillion economy by 2047, we must tackle this issue with sustained, coordinated action, backed by robust enforcement and clear, enforceable laws. Today’s discussions made it evident — illicit trade is no longer a fringe problem. It operates like a global, organized network, exploiting legal ambiguities and enforcement gaps. This fight cannot be won by governments alone. Industry must invest in authenticity and consumer protection. Citizens must be aware and vigilant. And we need deeper international collaboration to enable joint investigations, intelligence sharing, and harmonized standards.”

During the event, FICCI CASCADE, jointly with the Thought Arbitrage Research Institute (TARI), released its report - “Decoding the Journey of GST Reforms: GST and Its Effect on Economy, Business and Household Consumption”. The report affirms that GST 2.0 marks a landmark reform, reshaping India’s indirect tax system to directly improve ease of living for households and ease of doing business for enterprises. During its valedictory session, Enforcement officers, school children, and journalists were felicitated at the anti-counterfeiting and anti-smuggling awards ceremony held during MASCRADE 2025.