Liberalisation was not voluntary but was egged on by global lenders who would not lend without a firm Indian commitment on ‘reforms’

Thirty years and India is still waiting for the dream to become real. The liberalization of the economy in 1991 is erroneously taken as being limited to divesting government assets and holdings in industry.

Liberalisation was not a voluntary decision but was nudged by major lenders, the IMF and World Bank, who threatened to stop lending without a firm commitment to “reformsâ€. The country went through a foreign exchange crisis in the late 1980s and 1990s and family jewels were pawned because forex reserves plunged to unexpected lows. In July 1991, the RBI pledged 46.91 tonnes of gold with the Bank of England and Bank of Japan to raise $400 million to meet its international obligations. The reforms that meant losing government assets to the private sector started with a “bang†but did not bring the private sector to par with the government. The reforms initiated by the then finance minister, Manmohan Singh, were not a roaring success but a piece of confusing policy that has dumped subsequent governments into a policy quagmire.

While liberalizing the society from licence-permit raj was welcomed, the process of doing so gradually became complicated. Changes were made in industrial policy, monopolies law was annulled, import licensing was abolished, India joined WTO and TRIPS, quantitative restrictions on import of manufactured goods and farm products were removed, and current account convertibility was introduced, business processes were eased, and the GST was introduced.

But disinvestment of public assets caught all attention. Every government took pride in selling assets or being seen doing that. Still, the private sector is suspect in the eyes of the bureaucracy.

It is still a mystery why a partial opening up was considered revolutionary. India is still not free of its socialist mindset and a preference for government control on the pretext of “concern for people’s welfareâ€.

The “reforms†worked a bit. But the pandemic impoverished 80 crore people. Growing joblessness during the lockdown pushed the middle class to the edge of poverty. This is reflected in the slow growth of the GDP. In 2020-21, India’s economic growth slowed and contracted by 7.3 per cent, the NCAER says.

Liberalisation in 1991 was followed by a series of Rs 7 lakh core scams - Harshad Mehta to Ketan Parekh, UTI, LIC (about Rs 2 lakh crore), and a series of banks, leading to a JPC probe. The top scams are coal allocation (Rs 1.86 trillion), 2G spectrum (Rs 1.76 lakh crore), Waqf Board land (Rs 1.5 lakh crore), Commonwealth Games (Rs 70,000 crore), Telgi stamp (Rs 20,000 crore), Satyam (Rs 14,000 crore), and Hawala scandal (Rs 100 crore).

Scams of such magnitude had never happened since Independence. Every divestment deal was also questioned. While the large private houses acquired these assets with loans from public sector banks, it also opened up an era of high bank losses (NPAs) particularly after the Lehman meltdown in 2007-08. The RBI Financial Stability Report (FSR) says despite banks writing off Rs 23,786 crore loans in 2019-20, enabling the PSU banks to show lower NPAs, banks could go into severe stress as it fears the NPAs may escalate to 16.2 per cent by September 2021 as borrowers are saddled with unpaid dues.

Repeated reorganization and mergers of banks have not boosted confidence. The latest move to sell four major banks and LIC is not being seen as a happy event. Many buyers could be from the list of 50 major defaulters.

Since 1991, government assets worth Rs 3.63 lakh crore were divested. During 2014-19, Rs 2.79 lakh crore worth asserts were disinvested. The target set for 2020-21 is Rs 2.1 lakh crore. The money received is adjusted in budgetary expenditure and is not known to have been used for building assets.

In 2016, demonetization shook the economy. The cash flow was severely hit, affecting sales of goods and commodities. People’s purchasing power collapsed, delaying the post-pandemic industrial, real estate, and market recovery. It might lead to years of moderate to slow post-pandemic growth and that means a severe resource crunch. Thirty years since the reforms, the power sector is in a mess again and agriculture remains the mainstay of the economy.

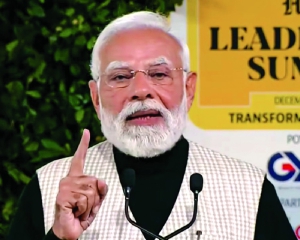

Have we made progress? Prime Minister Narendra Modi says his government is working for a targeted $5-trillion economy. But former PM Manmohan Singh says that the future economic path is tougher than in 1991. Either way, the country must bite the reforms bullet and recast its policies keeping in mind growth in the next 30 years.

(The writer is a senior journalist. The views expressed are personal.)