NOIDA Authority evaluated applicants’ net worth overlooking the fact that the builders had applied for many plots in different schemes during the audit period

The C&AG has observed that allotment of two plots (GH 01 & 02, Sector-143) of more than two lakh sqm worth Rs 471.57 crore was made to Logix group of companies promoted by Shakti Nath in 2011, who failed to even qualify the technical eligibility criteria of a turnover of Rs 200 crore from real estate development and construction activities. In both cases, the bids should have been outright rejected. The Authority also failed to examine whether Logix group consortium had the requisite aggregate Net Worth to qualify for allotment of multiple plots.

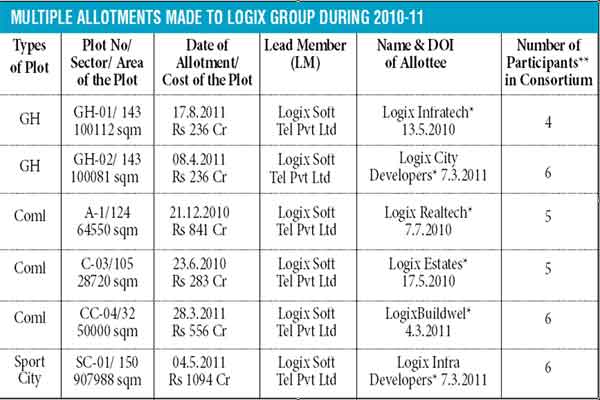

It was further noted that the Authority had already earlier been allotted 3 commercial builder’s plots (A-1/124, C-03/105 and CC-04/32) of 143250 sqm to ineligible Logix Group consortiums at the cost of Rs 1680.93 crore a few months ago in 2010-2011 even when they failed to meet the mandatory technical eligibility criterion of minimum turnover of Rs 200 crore from real estate development and construction activities and aggregated Net worth required for the plots. In addition, the Authority allotted another much bigger plot of sport city of 224 acre (907988 sqm) in Sector 150 in May 2011 to the ineligible Logix group consortium at the cost of Rs 1094 crore, overlooking the mandatory technical eligibility criterion of minimum turnover of Rs 200 crore from real estate activities during the previous three years (2007-2010). The Lead member of each Logix Group consortium was a software development company namely Logix Soft Tel Pvt Ltd. It has paid up capital of Rs 14 croreand turnover of Rs 9.70 crore in 2009-10. Thus, the Authority allowed the Logix Group consortiums led by a small software company to grab six large plots aggregating more than 300 acres valuing Rs 3246 crores in 2010-11.

Note: The Company had the paid up capital of Rs 1.00 lakh.** None of the participants in any consortiums had turnover in real estate development and construction activities.

The filings of Logix Soft Tel Pvt Ltd with MCA/GOI claimed that they became the holding company of 22 newly incorporated subsidiaries in 2010-2011. As per the Audit report, the modus operandi followed of Logix group was to submit bids for each plot through a Consortium (of 5-10 subsidiary /associate companies) and after allotment of the plot, the key members of consortium would exit and plots would be divided into sub-plots and allotted to subsidiaries, who in turn would sell/transfer the sub-plots to third parties. Mr Shakti Nath had constituted more than 50 subsidiary companies during 2009-12 in which Meena Nath and/or Vikram Nath were also directors. Shakti Nath is presently director in 33 companies, Meena Nath in 43 companies and Vikram Nath in 16 companies.

Three C (3C) group of companies on the strength of Three C Universal Developers Pvt Ltd, incorporated in March 2007, were allotted 3 GH plots of 3,84,295 sqm of Rs 860.66 crore, 4 Commercial builder’s plots of 138286 sqm at the cost of Rs 1548.27 crore and two Sport City plots of 20,32,747.72 sqm (502.29 acre) at the cost of Rs 3428.58 crore. If this was not enough, a national newspaper has reported that the directors of 3C group of companies and their family members- Nirmal Singh, Surpreet Singh Suri, Vidur Bhardwaj and wife Richa Bhardwaj were also allotted 8 farm houses plots of 10,000 sqm each in prime sectors of the Noida city at throw-away prices in 2010-11. The 3C group had the outstanding dues of Rs 4694 crores as on 31st March 2020.

In all biddings, 3C Group used the parameters of Three C Universal Developers Pvt Ltd (DOI-7th March 2007, Turnover- Rs 155.6 cr & Net-profit-Rs 8.92 cr in 2009-10) to meet the technical eligibility criterion to grab multiple plots. The 3C group of companies also followed the same route of bidding through consortium of subsidiaries companies in grabbing the plots. The Directors- Vidur Bhardwaj, Supreet Singh Suri and Nirmal Singh had constituted large number of subsidiaries/associate companies during the period 2008-2012, bid through consortiums led by different subsidiaries and have since resigned from most of them. As per MCA records, Vidur Bharadwaj is presently a director in 4 active companies only but during the 2008-2012, he was director in more than 100 companies. Supreet Singh Suri and Nirmal Singh were also directors in more than 100 companies during this period.

Undue favour to builders by using net worth for multiple allotments.

In course of processing the bids, NOIDA Authority evaluated the net worth of the applicant companies case-wise, overlooking the fact that the builders had applied for many plots in different schemes during the audit period. As a result, the Authority failed to determine requirement of the net worth in aggregate in case of multiple applications of an applicant company/builder. Resultantly, several allottees/companies obtained more than one allotment of plot by leveraging their net worth multiple times. In a test check of GH plots, the C&AG found that 10 applicants were allowed to use their net worth more than once to garner 26 (sub-divided into 43 plots) allotments worth Rs 4,293.35 crore. The beneficiaries were: Supertech Ltd and Gaursons Ltd obtained 4 plots each, Ultra Homes and Gulshan HomZ got 3 plots each, Prateek Buildtech, Amrapali Homes, Unitech Ltd, Ajnara India, Agrawal Associates and Bihariji Ispat one each.

Over the years, Noida Authority relaxed many important terms and conditions like financial qualifications criterion of net worth, solvency and total turnover, provisions of escrow account, bank guarantee etc. The Authority also kept on reducing the payment of upfront allotment money from 40 per cent of the land premium in 2006-07 in phases to as low as 10 per cent in 2009-10. In 2009, Noida Authority took further steps viz. rescheduling of eight-year repayment term with two-year moratorium, sub-division of plots (above 40,000 sqm), transfer of sub-plots, deposit of 10 percent of lease premium till execution of lease deed, etc., to provide relief to the allottees ostensibly to combat the 2008 recession/economic conditions. The Authority however continued these rebates/ relaxations indefinitely. As a result, the allottees were required to make the payment of lease premium/cost of the plots over a period of ten years from the date of allotment. This reduction substantially reduced the financial commitment of the developers and enabled them to garner more or bigger plots and launch more and more projects without completing the existing ones. Further these plots were sub-divided and illegally transferred/sold to third parties on premium through changes in the share-holding of the subsidiaries companies. (To be continued)

(The writer is a retired DG of the C&AG of India and a member of RERA, Bihar between April 2018-December, 2021. The views expressed are personal.)