The interest rate hike will add to the woes of the common man

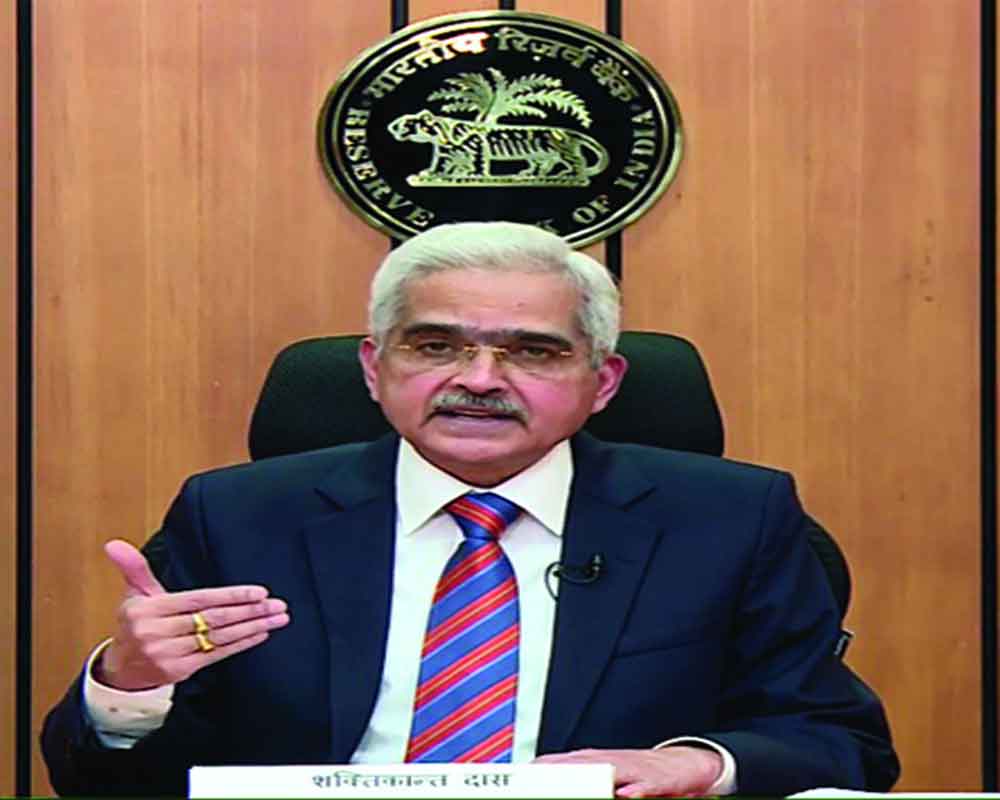

The RBI’s decision to hike the interest rate by 40 basic points has not come as a surprise. The writing was clear on the wall. The sharp rise in inflation, geopolitical tensions, high crude oil prices, and shortage of commodities globally are the reasons cited by the RBI governor Shaktikanta Das to justify the interest rate hike. Except for the stock market players, any saner elements would have foreseen that the RBI was bound to act, and act now, to cool the overheated economy. In fact, experts have been critical of the Central bank’s accommodative instance. For the last couple of months, they have been saying that it was time for the RBI to go for tightening its monetary policy. It will be erroneous to put the entire blame for rising inflation on the Ukraine war. Things had turned messy even before the Russian troops landed on Ukraine soil in the last week of February. In fact, retail inflation hit nearly 7 percent in March and held above the upper end of the RBI's target band of 2-4 percent for the third month in a row. The RBI in April raised its inflation forecast to 5.7% for the ongoing fiscal, up from its 4.5% in February. However, The decision will come as big blow to the common man, who is already reeling under all-round rise in the prices of consumer goods, fuels, and other essentials. To begin with, people will have to pay higher monthly EMI on their loans.

All retail loans, including home loans, car loans or personal loans, are likely to become expensive. However, the rate hike will bring some cheers to those who have made long-term fixed deposits in banks, The interest rate on such deposits is expected to go up proportionately. The repo rate high will herald a big negative for the real estate sector. After several years of de-growth, the housing construction sector was picking up. The prospective buyers of properties tend to withhold such purchases till the time the interest rate starts cooling off. The interest hike will also impact the prices of cement, steel, glass, pipes, labor cost,s etc. At a time when joblessness has become a serious issue at the national level, the slowdown in real estate will add to the problem. Consider the fact that the real estate sector is one of the biggest job sectors in the country.