As a Budget, it would be moderate on consumption, average on growth and the pace would be possibly as good as it was this year

The Union budget introduces digital crypto currency, gives incentives to kisan, industry and leaves out the wage workers high and dry as direct income-tax remains untouched.

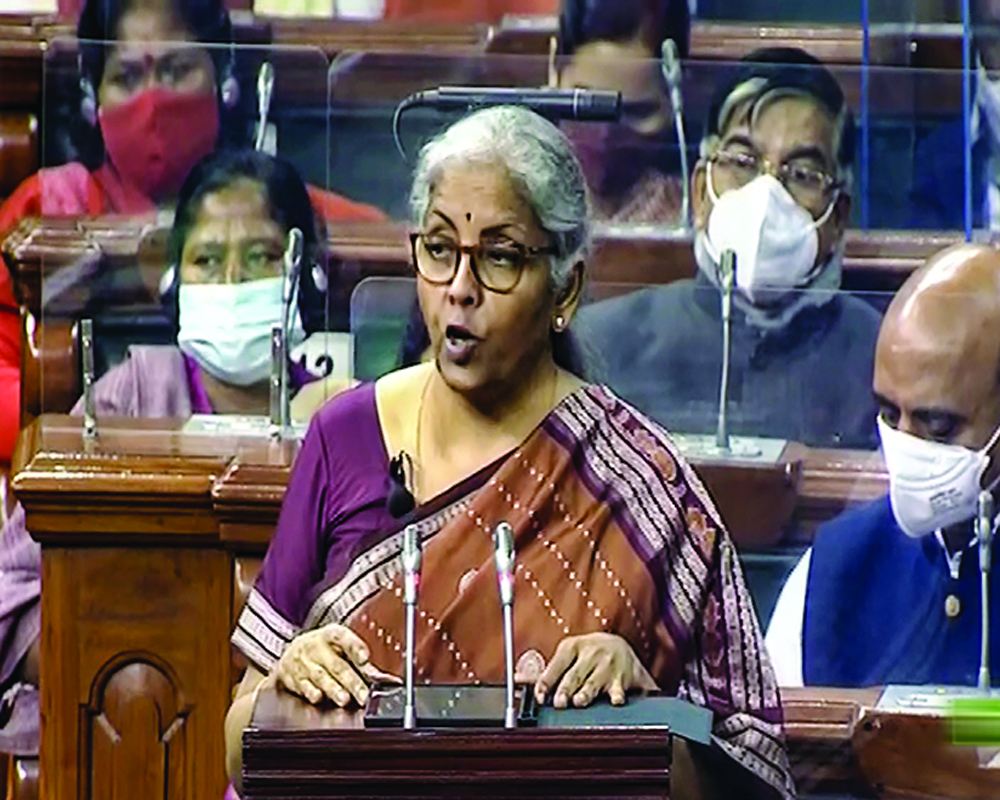

Finance Minister Nirmala Sitharaman expects to create 60 lakh jobs under the productivity-linked-incentive (PLI) scheme in 14 sectors. The government hopes that it has the potential to create additional production Rs 30 lakh crore, a bit high of an expectation amid a subdued Economic Survey that does not show much enthusiasm for “spend and enjoy”.

The MSMEs get into about Rs 2 lakh crore largely credit support. They are in critical state, it is to be seen whether they would be able to have the benefit and thrive.

The e-Vidya and the National Digital University is a welcome step for the students and scholars. If data cost even after 5G remains low it would provide countrywide standard education at low cost.

Her expenses rise marginally to Rs 39.44 lakh crore from Rs 37.70 lakh crore in 2021-22. Her borrowings increase to Rs 16.61 lakh crore from Rs 15.91 lakh crore. Fiscal deficit at 6.9 percent, reduced from budgeted 9.2 percent, in 2021-22; has come down to 6.4 percent.

The growth figures projected at 9 percent, though coincides with IMF projections has a catch of minus seven percent growth two years back. Still the actual has to come back to the 2019 level.

The roadmap is to be created through capital expenditure, introduction of 5G communication technology, the Central Bank Digital (crypto) Currency, massive purchase of paddy and wheat from kisan and the master plan for roads and highways.

She says she is setting the pace for India’s ‘Amrit Kal’ -75th year- and eyed economic growth for India over the next 25 years.

Of course, she has extended a number of tax benefits to the lowering or rationalizing many rates for different industry players. She says that there was discrepancy in rates and she has just brought it to the realistic level. Customs duty cuts on chemicals and other raw materials are welcome for Aatmanirbhar Bharat programmes for increasing domestic production and re-export at competitive rates. It boosts exports.

The Government has massively increased capital expenditure target to Rs 7.5 lakh crore from Rs 5.5 lakh crore in the last Budget for FY23. It is expected to give an overall boost to economy and create jobs. The basic thrust of job creation of would be through investment in infrastructure creation. It works as per the psyche that more the infrastructure prospecting finances from banks more would be the need for employing people. This year expenses were at 2.48 lakh crore or about 49 percent. If the government is able to spend the entire amount of Rs 7.5 lakh crore, it can create wonders.

Alongside, Finance Minister Sitharaman announced that the RBI will roll out the Central Bank Digital Currency (rupee) using blockchain and other technologies. “This will give a big boost to the economy”, she says. It makes international transfer of money, capital, easy. It can have many businesses done without touching the formal transaction routes. Capital inflow and outflow becomes simpler. In a way it integrates the country with the international crypto currency, whose pros and cons are being studied. Since it is a regulated currency by the RBI, it is not likely to have the problems that unregulated crypto system has.

It is also tax integrated, one percent for each transaction to maintain its trail and 30 percent on the earnings as in the income tax provisions. Many governments are yet to accept the crypto but in the parallel market it is becoming an accepted currency.

Keeping an eye on the elections and the recent Kisan stir, that led to withdrawal of three farm bills she announced higher allocation of procurement of wheat and paddy under MSP operations. She spends Rs 2.37 lakh crore and hopes this would have a better impact on kisan lives. Stressing on the international year of millet, she hopes to diversify the food habits and give famers more options for growing different crops.

The expected rise of the PM Kisan pension has not happened. Rightly so perhaps because despite 67 percent rise in revenue it still is not at comfortable level.

The finance minister’s hope to have 60 lakh jobs in a year, a reminiscence of the days of Atal Behari Vajpayee, in an economy that has yet to come out of the Covid-19 syndrome is an optimistic move. It, however, requires that much of consumption and manufacturing recovery. The industry has weightage of 28 percent in GDP calculation. Still the income recovery is at a low and sudden boost to consumption is a highly placed expectation.

The investments will be trooping in but may not be at the desired pace. Of course, stock market so far is buoyant. But capital investors may like to wait to wait to come out of the Covid-19 syndrome uncertainties.

She proposes some minor direct tax reforms. It remains largely restricted to allow the state government employees also have the standard deduction at per with central employees. Her assessment of having a mere 3.8 crore income tax payee is also not correct. In this country everyone pays a high indirect tax of approximately 40 percent even the 82 percent who are not in the income tax net. She knows that that the tax by individual is at a high of 30 percent plus cess against the corporate tax of 22 percent. The mismatch is illogical.

The earning salaried classes are about 3.75 crore and they all are in the tax net. The compliance is full specially in a situation where there has been income contraction in the private sector and corporate are paying low taxes compared to individuals. Tax evasion as she says is more a myth. Interestingly they also pay GST, which brings Rs 1.40 lakh crore in January 2022.

Overall, the budget has dreams, euphoria, indirect aspirations at growth like the stress on drinking water projects, 28,000 crore to housing projects, national digital health system, integrated rail-air-road projects and the like.

Vast sections of the population are excluded. The sections struck by extreme poverty, migrant labourers do not have a strong prescription. It is expected to be a job-generating budget with lots of gifts for the citizens.

As a budget, it would be moderate on consumption, average on growth and the pace would be possibly as good as it was this year.

(The writer is a senior journalist. The views expressed are personal.)