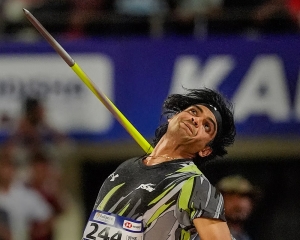

Giving women direct access to financial services might improve their chances to become entrepreneurs, more independent and increase their participation in family decision-making

Women make up nearly half the population. A nation cannot have sustained economic prosperity and well-being until the central role of women is recognised and their economic health is used as a measure to shape policy. The human race is like a bird that needs both wings to fly. A great opportunity is wasted when women are isolated from the economy. It is now widely surmised that until they are financially literate and empowered around money, we’ll never truly have equality. Women’s participation in the financial system can have significant benefits in terms of economic growth, greater equality and societal well-being. When accessible finance reaches women, the benefits are particularly sustainable. Women channel money into solving more fundamental issues.

Access and usage of financial services are levers for increasing women’s participation in the economy. They enhance their self-confidence and place financial decision-making power in their hands, resulting in large development pay-offs. We need to study the myriad social and behavioural impediments impacting women and use this knowledge to design customised financial product offerings. In failing to develop client experiences rooted in men and women’s fundamentally-different perspectives on finance, banks are missing a very significant business opportunity.

Women often face several barriers which limit their financial inclusion, other than the universal constraints that low-income communities face: Limited access to mobile phones, lower literacy levels, less confidence in using technology and restrictions on travel or social interaction. We need to address them through behavioural and reformist approaches, instead of the usual hardware-based approach. It’s not that the barriers are necessarily different for rural and urban women. But the same barriers are greater for rural ones. We need last-mile banking agents to help mitigate barriers such as dependency on male family members for travel.

Women make for a low-revenue segment but prove to be loyal and profitable clients when served with appropriately-designed products. Financial service providers need to ensure that their charges are not prohibitive and the tools are so designed that they make women’s engagement with financial service providers friendly, safe, affordable and convenient. The real issue is that many women, despite strides in education, simply aren’t as confident and knowledgeable about financial matters as men. This problem persists even when women handle many of their families’ routine money management duties.

Giving women direct access to financial services might improve their chances to become entrepreneurs, more independent and increase their participation in family and community decision-making. There is also an important insurance effect: Better access to credit, savings or insurance services reduces the need to use child labour as a buffer in case of seasonal income fluctuations and transitory income shocks and allows consumption. In the case of transitory income reductions resulting from health shocks, it also allows faster attention to health problems.

It is now recognised that “the women’s market” represents varied segments of clients, from low-income salaried workers (factory workers, domestic help and so on) and low-income self-employed women in the informal sector, to women who work in agricultural value chains, to small-and medium-enterprises. Serving this market not only makes business sense, it also has a positive impact on society as a whole by expanding economic growth and job creation. When accessible finance reaches women, the benefits are highly productive and sustainable. The positive economic knock-on effects are obvious. Savings rates are higher, repayment rates of family loans are remarkable, families are healthier, social cohesion is stronger and business growth is stable. This shows that increasing women bank account holders will reduce systemic risks in the economy.

Women should be considered as a distinct segment with specific financial services requirements. Instead of disguising male-focussed products as gender-neutral, we need specific products tailored to their unique needs. Low-income women usually need timely and hassle-free credit to increase their financial prospects.

Women have restricted mobility due to gendered social norms, are sometimes unschooled and are not the sole decision-makers of their households. There is a need to actively employ oral informational management tools so that these women can transact independently. Women prefer to learn and work with peers. Bankers must build trust in this segment by using women agents in frontline financial operations. Behaviourally, women customers take more time to develop trust in a new product or service. The same holds good for finance and building confidence and trust in them requires more interaction.

In all societies, howsoever oppressed women may be or low the level of their literacy, they remain the stewards of household savings. Women investors have greater patience for long-term returns and show greater self-control, which results in less impulsive and risky decisions.

A lot more awareness has to be created in women about financial services. This underlines the need for inclusion of women policy makers in designing financial services so that the female perspective is kept in mind. If women are not involved in financial product design and service delivery, then the needs and preferences of women customers may be less likely to be reflected in the marketplace.

Most financial systems have been designed by and for men. Therefore, when an application is made for business or personal loan, the lender asks for collateral, such as land or a house. In most cultures, it is men who traditionally own the land or the house, which immediately excludes women. Plus, women are more price-sensitive and expect affordable fees.

Women are usually tasked with stretching the family budget in times of financial hardship. Providing micro-credit or a small affordable and account-linked overdraft could help them cover their day-to-day contingencies in management of household finances. A woman’s financial needs and responsibilities require bundled solutions of savings, credit and insurance because they are more relevant to her circumstances. There are several barriers that constrain the full inclusion of women in formal finance. Product-driven financial literacy is necessary to ensure that poor women are not short-changed. While financial products have their benefits, there is a clear danger of mis-selling, which could damage marginalised segments who have an uncertain cash flow. The philosophy which the financial inclusion community must foster is that engagement creates knowledge and knowledge creates confidence.

Professionals and practitioners have distilled some salient features of financial products and services that foster women’s active participation in formal finance. They find that women don’t have a straight financial journey and have more interruptions and life-stages in their financial lives (withdrawal from employment during pregnancy and in medical contingencies for nursing sick family members). They may remain active users of bank accounts during these periods. Women should be able to reactivate their accounts without much hassle or penalties. Micro-finance services are focussed on women but they are too loan-obsessed. The sector is awash in credit. In several cases, women are availing loans when their need is insurance, which is not affordable and easily available. The Government should consider recognising semi-formal titles of land as workable collateral.

One of the most promising ways to close the stubbornly persisting gender divide is technology. The large gaps in mobile subscriptions and ownership mean that if digital financial services are going to deliver on their promise to women, these gaps need to be taken into consideration. Mobile phones are an inspirational and utilitarian item that most of them long for. The key to harnessing mobile technology will be to make sure women have equal access to phones in the first place.

The overall gender gap in mobile phone ownership in the developing world is wider than the bank account ownership gaps. The onus is now on mobile providers to start making products more suitable and affordable for women. One reason for the technological divide is that smartphones are not marketed as an empowerment tool. Making gadgets available will surely help but we have to bring about a change in the overall outlook.

There are five criteria that need to be at the core of a successful women-inclusive strategy: Positioning products as solutions to problems; positioning information, education and networking as core products; building the financial capability of women customers; establishing an intelligent, no “pink marketing” zone; and training staff to listen to women rather than sell to them, creating a relationship-based business model that sustains their loyalty. In short, what is needed for a broader, deeper and more relevant and meaningful financial inclusion is a nuanced approach that tackles the underlying, interconnected barriers that women face in accessing and using financial services. We cannot overcome poverty until both men and women have equal rights and opportunities. This approach makes financial sense for everyone.

(The writer is a development professional)