The need to have a comprehensive Life Insurance plan is paramount in today’s fast-paced world. Considering this, it is important to have a life coverage plan like Term Insurance that not only suits your requirements, but also your budget. Read ahead to understand the factors that affect Life Insurance rates in order to fetch the lowest quotes.

About Term Insurance

Term life insurance is a Life Insurance policy that offers death coverage to policyholders for a specific period of time for which the plan is active. In most cases, the sum assured is given as a lump sum to the beneficiary when the policyholder dies during the policy tenure. Known to offer higher coverage at an affordable premium, Term Insurance does not provide maturity benefits.

These simple-to-understand plans are supremely affordable and come with tax benefits under sections 80C, 80D, and 10 (10D). It is best to buy a term plan at a young age because premiums will be lower then. When buying term life insurance, you should be mindful that the premiums are locked for the policy term.

Other benefits of opting for these pure and basic Life Insurance plans are the return of premium feature, the provision to enhance coverage using add-ons (accidental death benefit rider, critical illnesses rider, and terminal illness rider), and the choice in pay-out modes (lump sum, monthly/annual income or both).

Factors Affecting Term Insurance Premium

While buying a term life insurance plan, it is important to consider the factors that affect Life Insurance rates. This can help you get the best deal meeting not just your insurance needs but also your budget.Let’s read ahead.

● Age: Insurers consider your current age and life expectancy. It is believed that the younger you are, the less likely you are to die. And, this reduces your Life Insurance premium quotes.

● Gender: Life expectancy for females is around six years longer than males, as per the Centers for Disease Control and Prevention. Taking this into consideration, insurers charge women less than men for life coverage plans.

● Health: Another factor that affects Life Insurance rates is your health condition. Insurers term individuals with certain medical conditions (like high blood pressure, high cholesterol, diabetes, sleep apnea, anxiety or depression) riskier as they are more likely to have a life insurance payout sooner. For this purpose, insurance providers ask for medical records or access prescription drug databases. Besides, some insurers also take the height and weight of the applicant into account before approving insurance applications.

● Smoking, Drinking and Drug Abuse: Indulging in any of these practices can put you under the risky behaviour category, which can increase your Life Insurance rates. Not just cigarettes, consuming smokeless tobacco, chewing tobacco, pipes, nicotine patches and gum, e-cigarettes and vaping, can push an applicant into the smoker category. Notably, if you are using marijuana only occasionally, then you qualify for normal Life Insurance premium quotes.

● Family Medical History: If your parents and/or siblings have a history of cancer (breast, colon, pancreatic, prostate, and others), melanoma, cardiovascular disease, and/or congenital heart disease, then it can impact your Life Insurance quotes.

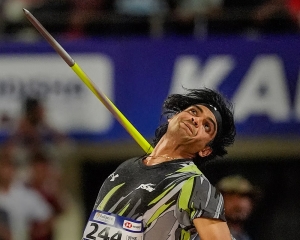

● Dangerous Occupations and Hobbies: Insurers consider activities, such as scuba diving, skydiving and piloting a plane hazardous. Hence, applicants engaged in related activities are considered risky to insure.

● Driving Record: If your license was ever suspended or revoked or you faced reckless driving convictions, then you are seen as a high-risk applicant by insurers.

● Criminal Record: Having a criminal record can not only affect your Life Insurance rates, but also your eligibility. Your Life Insurance application can face rejections if you are awaiting trial, on probation, in jail, or on parole.

● Financial Issues: If you have filed for bankruptcy in recent years, then the likelihood of your application getting rejected increases. Also, life insurers consider your credit situation to calculate risk scores before sharing Life Insurance premium quotes.

● Life insurance add-ons: Adding riders to your Term Insurance can not only enhance coverage, but also the peace of mind. Buying a waiver of premium rider will allow you to stop paying premiums if you become disabled during the policy term.

Conclusion

Term Insurance is known to offer higher coverage at a lesser cost when compared to other traditional Life Insurance plans. But, factors like your age, health, family medical history and financial issues can affect Life Insurance rates. While one cannot do anything about increasing age, controlling factors like health and smoking can significantly lower term insurance premiums. Reach out to ACKO for all your insurance needs.