Hit by oil crisis, Sensex tanks 642 points

Equity investors lost Rs 2.72 lakh crore in two days as market tanked for the second day in a row on Tuesday following spike in the crude price triggered by drone attacks on the world’s largest oil processing facilities in Saudi Arabia. The rise in geopolitical tensions in West Asia led to severe selling in the equity market.

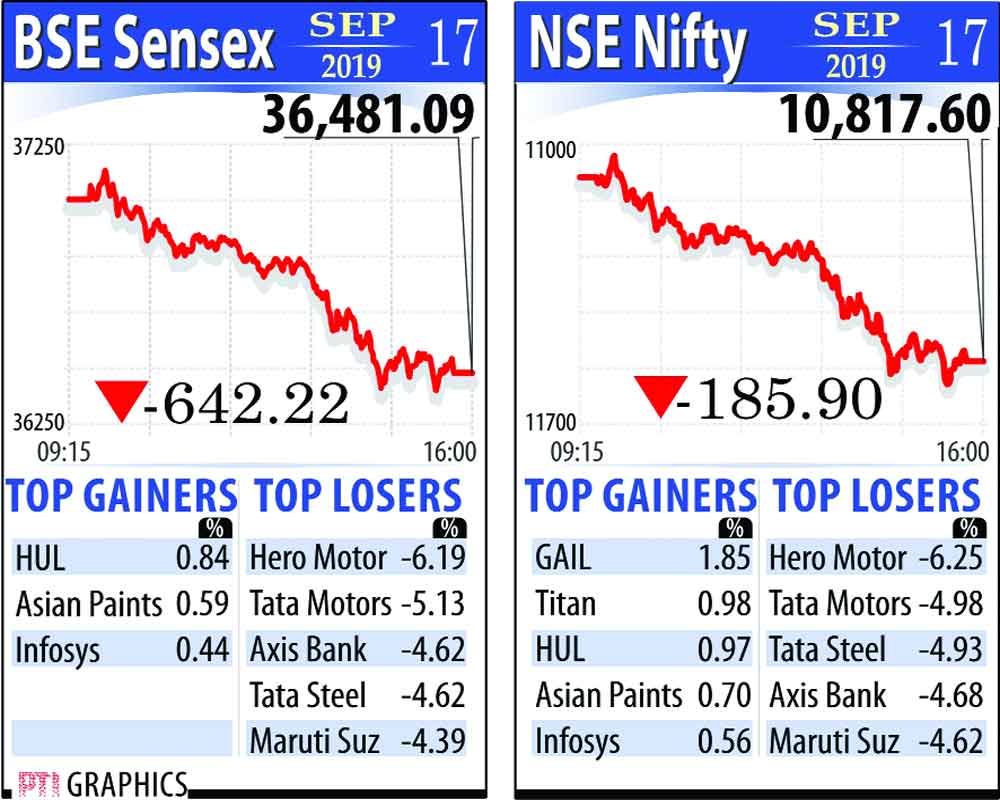

The Sensex on Tuesday plummeted 642.22 points or 1.73 per cent to close at 36,481.09. During the day, it dropped 704.22 points. Sensex on Monday tanked 262 points.

After soaring as much as 20 per cent to $71.95 per barrel on Monday, brent crude futures corrected slightly to trade at $67.97 per barrel on Tuesday.

Haunted by fear that elevated crude prices could worsen India’s fiscal concerns, the market came under vicious bear grip and even blue chip stocks could not withstand the sell-off. Led by the heavy selling in the market, the market capitalisation (m-cap) of BSE-listed companies was eroded by Rs 2,72,593.54 crore to Rs 1,39,70,356.22 crore.

All sectoral indices ended in the red, with BSE auto, realty, metal, banks, finance, oil and gas, energy, technology and IT indices falling up to 3.80 per cent. On the Sensex chart, losses were driven by Hero MotoCorp, Tata Motors, Axis Bank, Tata Steel, Maruti and SBI — falling by 6.19 per cent.

Only, Hindustan Uniliver, Asian Paints and Infosys ended in mild green. Broader BSE midcap and smallcap indices followed benchmarks, cracking up to 1.84 per cent.

The rise in crude prices could give nightmare to the Government, which recently announced a slew of measures to boost up the economy. Each dollar rise in crude prices lead to a burden of Rs 10,000 crore on India’s oil import bill. Even if oil prices were to settle at a level which is 5-6 dollar more from average of the last year, India will stare at a very tough situation.

While RBI Governor Shaktikanta Das warned on Monday that India’s current account and fiscal deficits could worsen if oil prices remain at the elevated level, many experts felt that higher oil prices were likely to severely hit economic conditions in India, which imports more than 70 per cent of its oil needs.

“Selling intensified as surge in oil prices and weakening rupee reduced the scope of economic turnaround in the near term. Banks were impacted the most while investors are in a pessimistic mood as stimulus packages from the Government are not adding any resurgence in sentiment. On global front, announcement of FED policy on Wednesday will be keenly watched and consensus is showing 25bps rate cut to counter low inflation,” Vinod Nair, Head of Research, Geojit Financial Services told news agency PTI.

Tracking movement in oil prices, the rupee further depreciated by 18 paise to 71.78 per US dollar.

Adding to woes, foreign investors continued with their equity selling spree in the Indian market. Foreign institutional investors (FIIs) sold equities worth Rs 808.29 crore on Tuesday, exchange data showed. Market participants were also on edge awaiting cues from the upcoming trade talks between China and the US as well as a much-anticipated policy meeting of the Federal Reserve, scheduled to begin later in the day.

Elsewhere in Asia, Shanghai Composite Index and Hang Seng ended significantly lower, while Nikkei and Kospi settled in the green. US stocks were trading in green in early sessions.

Meanwhile, the Finance Ministry is working on one more booster dose to give a leg-up to the economy that has hit over six-year low of 5 per cent, a senior Finance Ministry official told PTI.

The blue print for the stimulus is ready that would be announced by Finance Minister Nirmala Sitharaman in the next few days, the official said without giving further details.

The Government announced a slew of measures in three dosages which include a special window for real estate, export incentives, bank consolidation and sops for micro, small and medium enterprises (MSMEs) and the automobile sector.